working in nyc living in pa taxes

Withholding tax requirements Who must withhold personal income tax. This tool compares the tax brackets for single individuals in each state.

Answer 1 of 11.

. You have a permanent place of abode there and you spend 184 days or more in the city. You pay out of state income taxes to the State of NY on portion of income earned in New York imagine if. You probably wont want to though.

NY does have a higher tax. Your wages while working there. Nonresidents are taxed on income sourced in the state ie.

You pay state and federal taxes in the State of PA on total income. Like most US States both New York and New Jersey require that you pay State income taxes. This means for example a Pennsylvania resident working in one of those states must file a return in that state pay the tax and then take a credit on his or her Pennsylvania return.

Be careful about telecommuting days. The TP lived in New York City until he moved to PA on 08312020. Living in PA and Working in MD Pros and Cons Pennsylvania 10 replies Tax implications of living in PA and working in NY Pennsylvania 3 replies Living in Reading Area.

Individuals who earned less than 200000 in 2021 will receive a 50 income tax rebate while couples filing jointly with incomes under 400000 will receive 100. You are a New York City resident if. I am working on a multi state tax return.

If you are still receiving income from NY then yes you are still liable for NY income tax. I work in new york but live in pa. Working in nyc living in pa taxes Monday May 30 2022 Edit.

If you are an employer as described in federal Publication 15 Circular E Employers Tax Guide and you. On your PA return. I grew up in a small town in Pennsylvania essentially right on the border of New Jersey along the Delaware river.

Use this tool to compare the state income taxes in New York and Pennsylvania or any other pair of states. Your domicile is New York City. For one it boasts a low cost of living and a very low-income tax.

Your domicile is New York City. This form calculates the City. Answer 1 of 6.

Youll be taxed by NY for your NY earned income at least NYC tax doesnt apply to non-residents so itll just be NY state taxes on your wages. Since he lived in NY for over 184 days he is considered a NY. NY will want you to figure the NY State income tax.

You will also have to file a resident Pennsylvania tax return and report all income regardless of. In short youll have to file your taxes in both states if you live in NJ and work in NY. On your PA return theyll figure out your PA tax.

Answer 1 of 11. Taxes Pennsylvania 3 replies.

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

/cdn.vox-cdn.com/uploads/chorus_asset/file/13720727/Chelsea_MaxTouhey_171115_14_00_44_5DS_9809.jpg)

Should You Move To New York Curbed Ny

219 S 18th St 1208 Philadelphia Pa 19103 Redfin

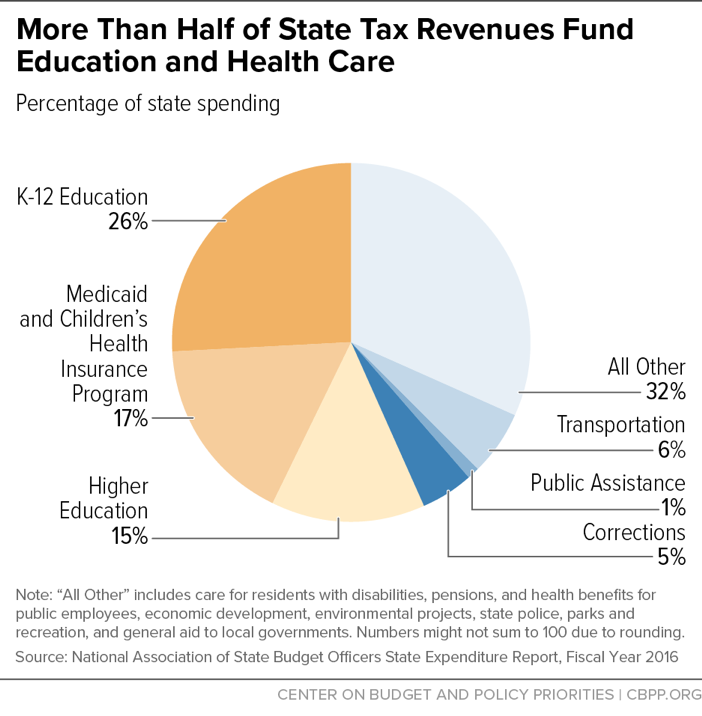

Policy Basics Where Do Our State Tax Dollars Go Center On Budget And Policy Priorities

Pennsylvania Tax Rates Things To Know Credit Karma

1911 Green St 3 Philadelphia Pa 19130 Redfin

10 Pros And Cons Of Living In Pennsylvania Right Now Dividends Diversify

Buying A Co Op In Nyc Key Questions To Ask In 2022 Prevu

2021 State Corporate Tax Rates And Brackets Tax Foundation

New York Property Tax Calculator 2020 Empire Center For Public Policy

2022 Best Places To Live In Pennsylvania Niche

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Find Local Tax Offices Professionals Near You H R Block Reg

Remote Workers May Owe New York Income Tax Even If They Haven T Set Foot In The State Marks Paneth

State Income Taxes For U S Expats Living Abroad H R Block

Pennsylvania Income Tax Calculator Smartasset

Mayor S Office Of Media And Entertainment

The Tenant Never Wins Private Takeover Of Public Housing Puts Rights At Risk In New York City Hrw

Additional Information About New York State Income Tax Refunds